st louis county personal property tax calculator

Get In-Depth Property Tax Data In Minutes. Account Number number 700280.

The following calculators can assist you with.

. Louis County collects on average 125 of a propertys. How Property Tax Bills are Calculated. November 15th - 2nd Half Agricultural Property Taxes are due.

November 15th - 2nd Half Agricultural Property Taxes are due. November 15th - 2nd Half Manufactured Home Taxes are due. An original or copy paid personal property tax receipt or a statement of non-assessment from your county of residence or city of St.

If you are a new Missouri resident or this is your first time filing a declaration in St. For personal property it is determined each January 1. The current statewide assessment rate for personal property is 33 13.

Charles County pays 2624 annually in. This rate applies to personal property as well as real property. City Hall Room 109.

Account Number or Address. Commercial real property however. To determine how much you owe perform the following two-part.

How to replace window guide clips. Louis County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax. Personal Property Tax Rate.

November through December 31st you may also drop off. Louis County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax. Louis County Missouri is 2238 per year for a home worth the median value of 179300.

Personal Property Tax Calculation Formula. Calculate a Separate Tax Rate for Each Sub Class of Property ie. To declare your personal property declare online by April 1st or download the printable forms.

The median property tax in St. Residential agricultural commercial and personal St. Personal Property Information.

For real property the market value is determined as of January 1 of the odd numbered years. Ad The Leading Online Publisher of National and State-specific Leases Legal Documents. Lilo and stich porn movies.

Please contact the State Auditors Tax Rate Section if you have any questions regarding the calculation of property taxes at 573-751-4213. Monday - Friday 800am - 500pm. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local.

Scdnr fishing license online. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. What happens if needle hits nerve.

Louis County is the only county using this method -. Ad Search Any Address in Your County Get A Detailed Property Report Quick. Personal Property Tax Department.

Property tax rates are amounts per 100 of assessed value on a piece of property. Account Number number 700280. Search Your County Records Online - Results In Minutes.

May 15th - 1st Half Agricultural Property Taxes are due.

County Assessor St Louis County Website

![]()

County Assessor St Louis County Website

County Assessor St Louis County Website

Amazon Com St Louis County Missouri Zip Codes 36 X 48 Paper Wall Map Office Products

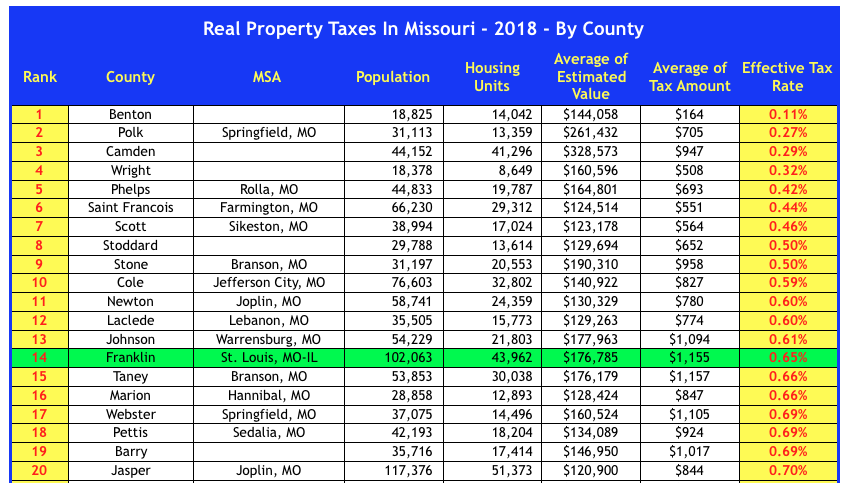

St Louis County Has The Highest Tax Rates In The State St Louis Real Estate News

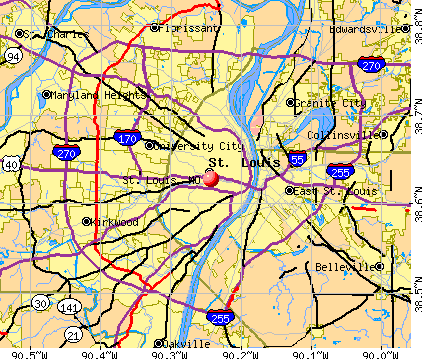

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

County Assessor St Louis County Website

Collector Of Revenue Faqs St Louis County Website

2022 Best Places To Buy A House In St Louis Area Niche

Residential Building St Louis County Website

Amazon Com St Louis County Missouri Zip Codes 36 X 48 Paper Wall Map Office Products

County Assessor St Louis County Website